SIP Calculator

Result

Total Investment: ₹

Total Maturity Amount: ₹

Interest Earned: ₹

SIP Schedule

| Month | Investment (₹) | Interest (₹) | Total Value (₹) |

|---|

- Unit Converter

- SIP Calculator

- Scientific Calculator

- Overtime Salary Calculator

- Nutrition Facts Checker

- Marks Percentage Calculator

- Lumpsum Calculator

- Love Calculator

- Age Calculator

- BMI (Body Mass Index)

- Calorie Calculator

- CGPA & Percentage Calculator

- Daily Protein Intake Calculator

- Daily Water Intake Calculator

- Data Storage converter

- Discount Calculator

- Duration Calculator

- Friendship Calculator

- Gratuity Calculator

- GST Calculator

- Loan Calculator

How to Invest in Mutual Funds Online for Beginners

Introduction

Investing in mutual funds online is an excellent way to grow your money over time. If you are new to this, don’t worry! This guide will walk you through the basics of mutual funds and the steps to start investing online.

What are Mutual Funds?

A mutual fund is a type of investment where many people pool their money together. This pool of money is managed by professional fund managers who invest it in various assets like stocks, bonds, and other securities. When the value of these investments increases, the value of your investment grows too.

Why Invest in Mutual Funds?

- Professional Management: Experts handle your money.

- Diversification: Your investment is spread across different assets, reducing risk.

- Liquidity: You can easily buy and sell mutual fund units.

- Convenience: Easy to start with a small amount of money.

- Potential for High Returns: Over time, mutual funds can offer good returns compared to traditional savings methods.

Steps to Invest in Mutual Funds Online

1. Understand Your Financial Goals

Before you start, think about why you want to invest. Do you want to save for a child’s education, buy a house, or create a retirement fund? Knowing your goals will help you choose the right mutual funds.

2. Choose the Right Type of Mutual Fund

There are different types of mutual funds:

- Equity Funds: Invest mainly in stocks. High risk, high returns.

- Debt Funds: Invest in bonds and other fixed-income securities. Lower risk, stable returns.

- Hybrid Funds: A mix of equity and debt. Balanced risk and returns.

3. Select a Mutual Fund Company

Choose a reputable mutual fund company or Asset Management Company (AMC). Look for companies with a good track record and customer reviews.

Open your SIP account free using Referral code: XN09694F8K

Direct link : Angel One

4. Complete Your KYC (Know Your Customer)

To invest in mutual funds, you need to complete your KYC process. This includes providing your identity proof, address proof, and a recent photograph. You can do this online through the mutual fund company’s website or apps like CAMS or Karvy.

5. Open an Account Online

Visit the website of your chosen mutual fund company. Look for the option to create a new account. Fill in your details, and link your bank account for easy transactions.

6. Choose Your Mutual Fund Scheme

Browse through the various schemes offered by the company. Compare their performance, risks, and returns. Select the one that aligns with your financial goals.

7. Decide Between Lump Sum or SIP

- Lump Sum Investment: Invest a large amount of money at once.

- Systematic Investment Plan (SIP): Invest a fixed amount regularly (monthly, quarterly).

8. Make Your First Investment

If you choose SIP, decide the amount you want to invest regularly and set up auto-debit from your bank account. For lump sum, transfer the amount to the mutual fund account.

9. Monitor Your Investments

Regularly check the performance of your mutual funds. Most companies provide online tools and mobile apps to track your investments easily.

Benefits of SIP

Systematic Investment Plan (SIP) is a smart and hassle-free way to invest in mutual funds. Here are some benefits:

- Disciplined Savings: Helps you save regularly.

- Power of Compounding: Small amounts grow significantly over time.

- Rupee Cost Averaging: Reduces the impact of market volatility.

Conclusion

Investing in mutual funds online is a simple and effective way to achieve your financial goals. Start by understanding your objectives, choose the right fund, complete your KYC, and begin investing. With regular monitoring and disciplined investing, you can build a substantial corpus over time.

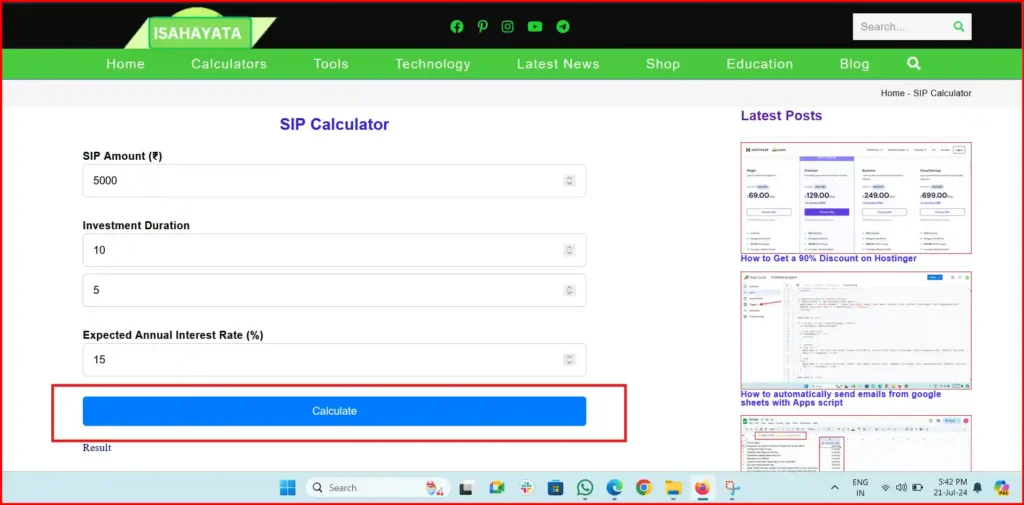

Isahayata.com SIP Calculator

Follow these simple steps to calculate your SIP amount using the SIP calculator on Isahayata.com:

Open Isahayata.com

- Go to your web browser and type in Isahayata.com. Press Enter to open the website.

Navigate to SIP Calculator

- On the homepage, you will see various options. Look for the SIP calculator directly on the homepage or go through the menu by selecting Calculators->Finance and then “SIP Calculator.”

Enter SIP Amount

- In the SIP calculator, you will see a field labeled “SIP Amount.” Enter the amount you plan to invest regularly.

Enter Investment Duration

- You need to specify how long you want to invest. Enter the duration in years and months.

Enter Expected Return Rate

- In the field labeled “Expected Return Rate,” input the interest rate you expect from your investment. This is usually expressed as a percentage.

Click Calculate

- After entering all the required details, click on the “Calculate” button.

See the Result in Graph

- The calculator will show you the estimated future value of your SIP investment based on the details you provided.

SIP Schedule

By following these steps, you can easily estimate how much your regular investments will grow over time using the SIP calculator on Isahayata.com.