What is Gratuity?

Gratuity calculator or Gratuity is a benefit provided to employees in recognition of their continuous service to an organization. It is governed by the Payment of Gratuity Act, 1972, in India. This act ensures that employees who have served a company for a significant period are rewarded with a monetary benefit.

What is gratuity amount

Gratuity is a lump sum amount paid by an employer to an employee as a token of appreciation for their service. It’s a way of saying thank you for the dedication and hard work over the years. This amount is usually paid when an employee leaves the job after serving for a certain period, typically five years or more.

Gratuity Calculator

- Unit Converter

- SIP Calculator

- Scientific Calculator

- Overtime Salary Calculator

- Nutrition Facts Checker

- Marks Percentage Calculator

- Lumpsum Calculator

- Love Calculator

- Age Calculator

- BMI (Body Mass Index)

- Calorie Calculator

- CGPA & Percentage Calculator

- Daily Protein Intake Calculator

- Daily Water Intake Calculator

- Data Storage converter

- Discount Calculator

- Duration Calculator

- Friendship Calculator

- Gratuity Calculator

- GST Calculator

- Loan Calculator

Benefits of Gratuity

- Financial Security: Gratuity provides a financial cushion when you retire or leave a job.

- Appreciation of Service: It is a reward for loyalty and long-term service to an organization.

- Tax Benefits: In many cases, gratuity is tax-free up to a certain limit, which can be a significant financial benefit.

- Peace of Mind: Knowing that you will receive a lump sum amount can provide peace of mind and security for the future.

Rules and Regulations

Understanding the rules and regulations surrounding gratuity is crucial:

- Eligibility: An employee must have completed at least five years of continuous service with the same employer to be eligible for gratuity.

- Formula: The formula for calculating gratuity is based on the employee’s last drawn salary and the number of years of service.

- Payment Timeline: The employer must pay the gratuity within 30 days of the employee leaving the company.

- Taxation: Gratuity received by an employee is exempt from tax up to a certain limit as specified by the Income Tax Act.

Calculate Gratuity using Isahayata.com

learn more : Youtube

Calculating gratuity can be done easily using the gratuity calculator on Isahayata.com. Here are the steps:

Step 1: Open Isahayata.com and Search for Gratuity Calculator

Go to Isahayata.com. This website offers various calculators, including a gratuity calculator for private employees.

In the search bar, type “gratuity calculator” or navigate through the menu: Calculators → Finance → Gratuity Calculator. This will take you to the gratuity calculator online.

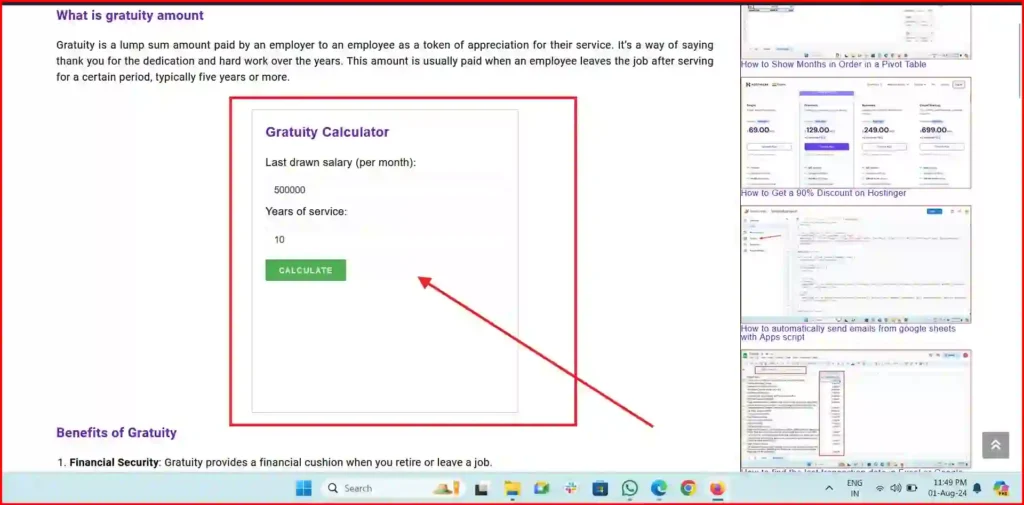

Step 2: Enter the Required Data

Once you are on the gratuity calculator page, enter the following details:

- Last Drawn Salary: This is your basic salary plus dearness allowance.

- Years of Service: This is the number of years you have worked with the employer.

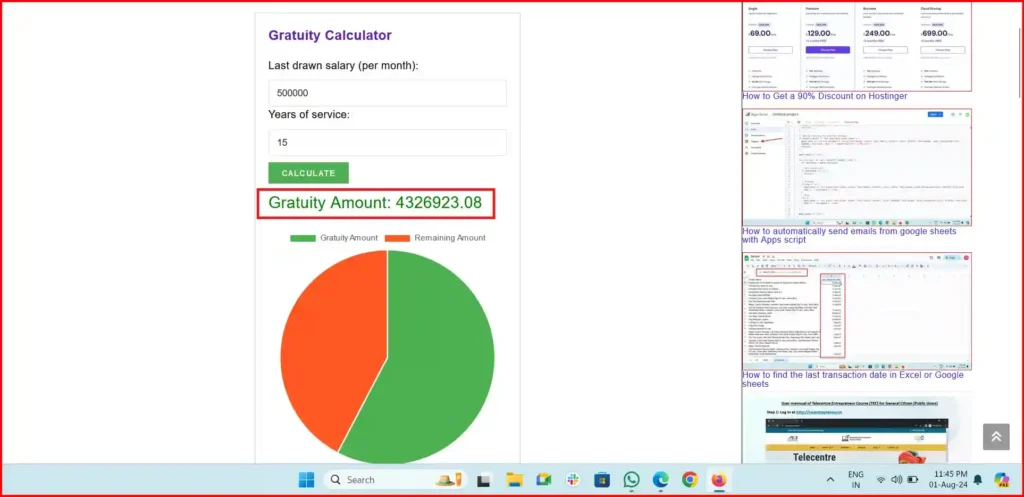

Step 3: See the Result

Click on the “Calculate” button. The gratuity calculator will show you the gratuity amount you are entitled to. It will also display a pie chart that visually represents the gratuity calculation.

How to Calculate Gratuity

Gratuity Calculation Formula

The standard formula for calculating gratuity is:

Gratuity = Last Drawn Salary × Years of Service × (15 / 26)

Here:

- Last Drawn Salary includes the basic salary and dearness allowance.

- Years of Service is the total number of years the employee has worked with the employer.

- The fraction (15 / 26) represents 15 days of salary for each year of service (based on a 26-day month).

Example Calculation

Let’s say an employee named John has worked with a company for 10 years and his last drawn salary is ₹50,000 per month (including basic salary and dearness allowance).

Using the gratuity formula:

- Last Drawn Salary: ₹50,000

- Years of Service: 10 years

- Calculation:

Gratuity = ₹50,000 × 10 × (15 / 26)

Let’s break it down step by step:

- Multiply the Last Drawn Salary by the Years of Service:

₹50,000 × 10 = ₹500,000

- Multiply the result by (15 / 26):

₹500,000 × (15 / 26) = ₹500,000 × 0.5769 = ₹288,461.54

So, the gratuity amount John is entitled to receive is ₹288,461.54.

FAQs About Gratuity

Q1: What is gratuity?

Gratuity is a financial benefit given to employees for their long-term service, typically after completing five years with an employer.

Q2: How is gratuity calculated?

Gratuity is calculated using the formula: Last Drawn Salary × Years of Service × 15/26.

Q3: Is gratuity taxable?

Gratuity is tax-free up to a certain limit as per the Income Tax Act. Beyond that limit, it is taxable.

Q4: What is 15/26 in gratuity calculation?

The fraction 15/26 is used in the gratuity formula and represents 15 days’ salary for each year of service, based on a 26-day month.

Q5: Can gratuity be denied?

Yes, gratuity can be denied if an employee is terminated for misconduct or has not completed the required five years of service.

Q6: What is the gratuity calculator formula?

The formula is: Last Drawn Salary × Years of Service × 15/26.

Q7: What is the meaning of gratuity in Hindi?

In Hindi, gratuity is called “उपाधि” (Upadhi).

Q8: How do I use a gratuity calculator online?

You can use an online gratuity calculator by entering your last drawn salary and years of service to get an instant calculation.

Q9: Are there gratuity calculators for private employees?

Yes, gratuity calculators for private employees are available online, such as the one on Isahayata.com.

Q10: Where can I find a gratuity calculator in India?

You can find a gratuity calculator in India on websites like Isahayata.com.

Gratuity is an important financial benefit that rewards employees for their long-term service. Understanding how to calculate it and knowing the benefits and rules can help you plan your finances better. Using a gratuity calculator online, like the one on Isahayata.com, makes the process simple and quick. Whether you’re a private employee or working in any other sector, knowing your gratuity entitlements is essential. Start using the gratuity calculator today to see how much you could receive as a token of appreciation for your hard work and dedication.