Best lumpsum mutual fund 2024

Lumpsum Calculator is useful tool to Investing in mutual funds can be a smart way to grow your money over time. One popular method is through A lumpsum investment means you invest a large sum of money at once, rather than spreading it out over time. To see how much your investment can grow, you can use it.

What is a Lumpsum Calculator?

It helps you understand the future value of your one-time investment in mutual funds. By entering some basic information, the calculator shows how much your investment could be worth after a certain number of years. This tool is very useful for planning your financial future.

Lumpsum Mutual Fund Calculator

- Unit Converter

- SIP Calculator

- Scientific Calculator

- Overtime Salary Calculator

- Nutrition Facts Checker

- Marks Percentage Calculator

- Lumpsum Calculator

- Love Calculator

- Age Calculator

- BMI (Body Mass Index)

- Calorie Calculator

- CGPA & Percentage Calculator

- Daily Protein Intake Calculator

- Daily Water Intake Calculator

- Data Storage converter

- Discount Calculator

- Duration Calculator

- Friendship Calculator

- Gratuity Calculator

- GST Calculator

- Loan Calculator

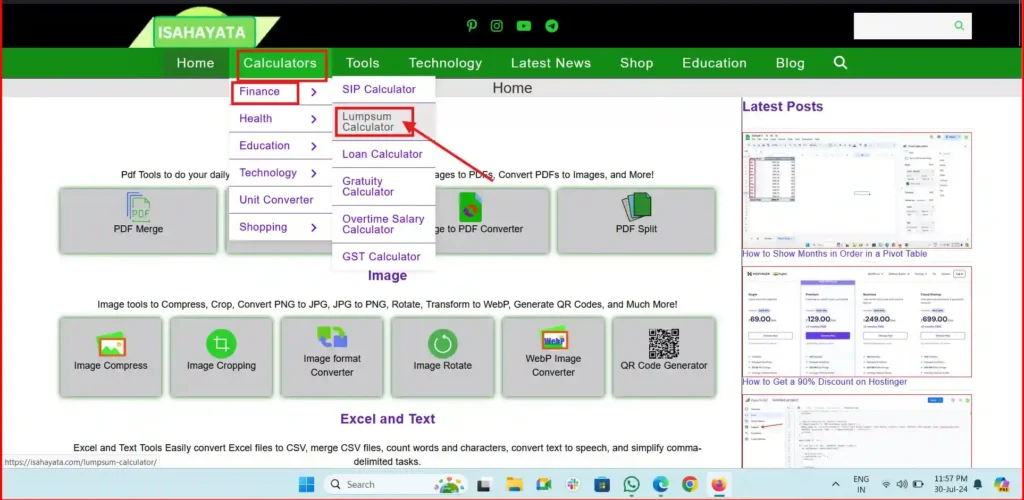

How to calculate mutual fund returns on Isahayata.com

Just follow these simple steps:

1. Open Isahayata.com

Go to the website Isahayata.com and Type “Lumpsum Calculator” in the search bar or navigate through the menus: Calculators –> Finance –> Lumpsum Calculator.

2. Fill the details

Enter the Amount: In the calculator, enter the amount of money you want to invest. For example, you might enter ₹100,000.

Enter the Expected Return: Next, enter the expected return rate. Suppose you expect a 15% return, enter “15%”.

Enter the Tenure: Enter the number of years you plan to invest for. For example, if you plan to invest for 10 years, enter “10 years”.

3. Click on Calculate: After entering all the details, click on the “Calculate” button. The calculator will show you the total interest earned and the total amount at the end of the investment period.

4. Results

In result you will see the expected returns on your investments.

Example Calculation

Let’s see an example to understand better. Suppose you want to invest ₹100,000 in a mutual fund with an expected return of 15% for 10 years. Here’s how you can calculate.

- Investment Amount: ₹100,000

- Expected Return: 15%

- Tenure: 10 years

After clicking “Calculate”, the calculator will show you the total interest earned and the final amount. In this case, the total amount might be around ₹404,556, and the interest earned would be ₹304,556.

Benefits

- Easy to Use: The calculator is simple and user-friendly.

- Quick Results: You get instant results showing your potential earnings.

- Financial Planning: Helps in planning your investments and understanding future growth.

- Accurate Estimates: Provides accurate estimates based on the input values.

FAQs

Q1: What is a lumpsum calculator? A lumpsum calculator is a tool that helps you calculate the future value of your one-time investment in mutual funds based on the expected return rate and investment period.

Q2: How is a mutual fund lumpsum calculator different from a SIP? A mutual fund lumpsum calculator is used for one-time investments, whereas a SIP (Systematic Investment Plan) lumpsum calculator is used for regular investments over a period of time.

Q3: Can I use the lumpsum calculator in India? Yes, the lumpsum calculator can be used in India. It is designed to help Indian investors plan their mutual fund investments.

Q4: How do I use a lumpsum calculator with inflation? To use a lumpsum calculator with inflation, you need to adjust the expected return rate to account for inflation. For example, if the expected return is 15% and the inflation rate is 5%, you might use a net return rate of 10%.

Q5: Is the mf lumpsum calculator accurate? Yes, its provides accurate estimates based on the information you enter. However, actual returns may vary based on market conditions and fund performance.